INTRODUCTION

Financial markets focuses on financial system . It is the market where financial products are exchanged and traded. In this there are many buyer and seller who is trade in this markets such as bonds , equity shares and derivatives. This report is based on Marks and Spencer company . In this report we explain the operation of financial markets and their importance and also explains main theories of financial markets and also analyse the operations and the efficiency of the financial markets. And in this report we also explain the appropriate financial data and indices which includes the share price to carry out analysis and efficiency of financial markets.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Q.1

A) Difference between different levels of market efficiency:

Market efficiency assumes that markets are efficient or productive . The efficient market main objective is stocks are trade in a fairest value . This refers to the chance to investors to gain higher return on which they invest and it is related with risk. Marks And Spencer company also consider the market efficiency techniques in the business.

There are three levels of market efficiency these are :

- Weak form

- Semi strong form

- Strong form

In weak efficiency , the market is efficient and in this assume that rates of return have been not affect to the market , it should be independent , and the shares future rates may not effect the present. In this all the information which is private or public and it is sometime available to investor or sometime not. Semi strong efficient market hypothesis, according to this hypothesis that the trader doesn't use any promulgated information to forecast the future price of shares. So if all information is already showing , its affect the stock price. In this hypothesis company information which is public is given to the investors and they related to present share price. Strong efficient market in this type of hypothesis all information should be given and even stock prices is also shown (Afonso, Furceri, and Gomes, 2012.).this is different from weak and semi strong forms of market efficiency . In this hypothesis investor is not known any information regarding share price and its gives the profit on share price trading.

Example of Weak form market efficiency is there , if stock price of a listed company in an exchange is a 30 day low it doesn't like that in future stock price go higher. Ex. of Semi strong market efficiency in this if a company show their earnings in the markets and the the trader watch the share prices change and after some the share holder may earn more from this markets. Example of Strong from markets , the company CEO is know only the private information related to their company , if the new share offer more earning so it express in stock prices.

b) Explain the efficient market reference to hypothesis literature

Efficient market hypothesis is used for to grow in the market because capital market efficiency and already exists share prices is always give the relevant information. Stock exchange gives an opportunity either purchase the low or undervalued price stock and sell stock in high prices (Awrey, 2012.). This hypothesis is not require the investor should be rational. There are three types of market efficiency so the weak from efficiency markets it advices that all old information is forming into securities. Marks and Spencer Is a branded company which is deals in apparel foot wear and many more items . If in weak form the Marks and Spencer share in an exchange markets the share price is low from last some times so according this strategy in future the stock price should be high in the markets. According to semi strong form the Marks and Spencer company should show their share earnings to the investor and the trader should watch the share price and bid according to this share prices and the trader earn more profit from after some time (Bolton, Santos, and Scheinkman, 2016). And in strong form of efficiency markets the company owner know about the share prices and the investor doesn't know about this company share prices and the company's share may earning from this. According to the hypothesis research the Weak form market efficiency is very appropriate because it is a reliable market and it gives the efficient market structure to the organisation or the company.

London stock exchange (London stock exchange)is the largest stock exchange in the world . In this stock exchange there are approximately 3000 companies and out of only 70 countries listed (International securities markets 2018). This the market where financial securities may borrow or lend . This is the very convenient place for trading the company securities. In context of efficient market hypothesis the share prices will reflect the all available information which is related to the stock market . If the information of stock is publically available to the investors , so only that time the efficiency market hypothesis is correct . For testing this theory we consider the share price for Marks and Spencer company.

This is show the company performance which is gone ups and down . This shows that LSE is efficient enough in accordance to EMH and as such, it can be said that performance of firm is maximized in the observation period as stock price which was declined, again hiked to much extent and as a result, LSE is efficient. The efficiency of the exchange can be made on this behalf as it is able to regulate markets in effective manner by which companies are able to perform as per the desire of shareholders in the best possible way. Moreover, more potential investors are attracting towards high performing companies such as M&S Company and as a result, higher returns are garnered by them because of the desired earnings generated by company with much ease Furthermore, share prices of M&S Company had not drastically fallen. It had picked up pace within short time duration without affecting overall efficiency of market. Thus, it can be said that LSE is highly efficient stock exchange.

Figure 1 GBP/USD Exchange rate

Figure 2 Euro to Dollar

Figure 3 UK Inflation rate

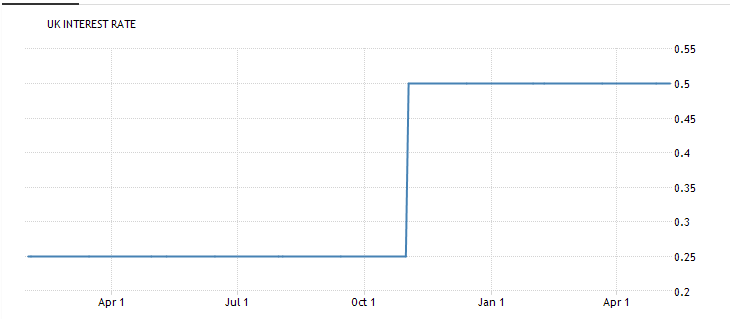

Figure 4 UK Interest rate

Figure 5 FTSE 100

The above graph represent Marks and Spencer Share ups and down . This is show the company performance is good in this markets. For testing the efficiency market hypothesis we taken this company share price . In this graph shows that the company has 120 transaction done in this scenario which is from January 2017 to June 17. So Marks and Spencer company made 120 transaction in this time . It is observed that the highest share price is approx 248 and 249 the highest point is 249 so the lowest stock price is 231 so there is not too much difference in this time of transaction. So it shows the stock price is highest level is 249 and lowest level is 231 . According to this graph it shows that the company share price is higher day by day . If this company share some times in down then after some time Marks and Spencer share price on higher level.

Q.2

Compare the role and functions of the capital markets with money markets:

Financial market is the place where Investor can deal in financial instruments like securities , share , derivatives etc. its is helps in allocation of savings in terms of investment . Financial market is divided into two parts capital markets and money markets . Money market refers to the market where short term securities are borrowed and sell in the market . Money market gives a variety of function for earning profit while investing on this. In this market funds are secured in market for short period its one year or less. It includes deposits , collateral loans, acceptances and bills of exchange. Marks and Spencer company also trade in capital markets they have their own shares (Capitals markets 2018 ). Many share holder may invest in this .Where capital markets is the most wide markets. It includes share, securities , bonds etc. which are trading in market. Capital market is the market where buy or sell the stocks for earning profits. It is used for long term investment . In this organizations and institutions trade financial securities for raising their funds. Money market deals in promissory notes , bills of exchange , commercial paper treasury bills etc. and capital markets deals with equity shares , debentures bonds and preference shares etc (Bond, Edmans, and Goldstein, 2012.). Capital markets main aim is that a market can provide a measure market where borrower and lender can purchase and sell the securities.

The role of the capital market compare to money market:

- Capital market plays an important role for faster industrial growth and money market is also help in to growth of the individuals .

- Capital markets helps the owner of an organisation to set their business beyond their capacity. And money markets helps in to short term investor for increasing their funds.

- In a developing countries there is need of funds for increasing the growth of the economy . These funds are carried to surplus economic units.

- Capital market is used for long term finance investments and money market is used for short term investment which is one year or less than one year.

- In money market there is low risk where as in capital market risk is greater.

Functions of capital markets compare to money markets:

- The main function of capital market and money market is to allocation of resources from that we getting desired objectives.

- Capital markets and money markets are satisfy the borrower and lender and the person or organisation who is investing in this.

- Capital markets plays an important role in to give the platform to the investor to earn more profits by investing their savings,and money markets give short term earnings.

Explain how money markets activities influences the assets price in the capital markets:

Money market is the the part of financial markets this is deals in short term borrowing and lending the funds. Their are some money market instruments T-bills, Negotiable certificate and commercial paper (Challet, and et.al 2013. ). Marks and Spencer company also influenced by this activities. Two activities or policy may influences the money markets these are:

- Monetary policy: this activity of government may affect the money markets and capital markets . Monetary policy is the procedure where government and bank manages the money supply for achieving some objectives . It includes inflation, deflation and to maintain exchange rate of the shares. This factor is also affect the capital markets because this policy affect the business , organisation or even nation so its affects the assets price in capital markets. For example if government increase the in any rates which affect the business and organisation.

- Fiscal policy: Fiscal policy is related with expenditure , in this government is set the level of expenditure and then this expenditure is used in funding. This is a macro economics tools , government is used this policy to manage the economy . This policy is used in for changing in government spendings and the taxes and this result is to slow down the economy (Coffee, Sale, and Henderson,2015). For example if changes in fiscal policy of government like increasing in nation to nation taxes this effect in capital markets and money markets.

Q.3

(a)Discuss the nature of potential risk in international transactions And explain how international traders manage the risks?

Nature of potential risk in international transactions:

When a company starts the business risk is involved in this. In international transactions risks is related with effect the unexpected risk on the value of the firm . Transaction risk is cash flow risk because it deals with the effect of exchange rate . For example A UK based company Receive a major business in out of the country . If the other country decrease the value of UK currency that is dollar. So this denominated the profits of the company . This foreign exchange risks is affect the organisation and the firm which is buy or sell the product and services in the financial markets (Edmans, Goldstein, and Jiang, 2012.). Changes in firm's value due to change in rate of exchange. Transaction risk is the changes in hoped-for contract between both of the parties and its results is unexpected changes in foreign exchange rates .

Explain how international traders manage that risk

Hedging:Risk is managed by international traders by choosing hedging strategies: it is the source for eliminate the foreign exchange risks. International trader is used this strategies for manage their risks. In this they transfer the risk to the other activities for hedging the funds . In the markets there are many assets traded , hedged fund is generally higher than expense ratio. There is a hedging instruments which helps in currency risks,these are Currency forwards, currency futures, Currency ETF, currency options. In currency forward the trader trade into forward contract where they sell in other currency and buy in other currency(Goodhart, and et.al., 2013.) . Currency futures it is used in when traders trade on an exchange , they only buy or sell the share in upfront margin . Currency ETF this is not mostly used in exchange risk. Marks and Spencer is used the hedging strategies for decreasing the exchange rate risks.

(b) Explain the main functions and operations of Eurocurrency markets and why this market is useful in international trade transactions:

Eurocurrency market: This the type of money markets in this the borrower or lender currency is held in bank which is external to the country. This markets is utilised by the banks. In this markets interest rates paid to the investor is much higher than the inside the country interest rate apply and this is because of the investor is not protected in inside country laws and they not have any government insurance. Eurocurrency markets firstly developed in London . Because bank is needed a market of dollar depositors (Junior, and Franca, 2012.). Its main function is Price stability in the markets , the quality and efficiency in the decision making , Economic growth can be measure in productivity developments. Marks and Spencer company should also choose this markets for earning profit outside the country.

Eurocurrency markets is very useful in international trade transaction because its give the higher return rate on the investment . In this markets many depositor may earn the profits. In Euromarket the international traders may invest in this and this is short term investment so there is low risk in investing the outside the country.

Q.4

a)Explain the following terms:

- Asymmetric information: In the financial markets asymmetric information relates , when two or more parties having some information regarding shares or trading rather than other so they take some informatics decision . For example if a trader or buyer and seller , buy or purchase the securities and buyer and seller having all the information related to the securities (Valdez, and Molyneux,2015.) . If a buyer know more about the securities that is it is under priced according to the performance similarly seller knows more about that securities . So both can have an opportunity to make profit for purchase or sale the security.

b)Moral hazard: This is a part of asymmetric information, it has risk from the party who has not come to the market for a good belief, they gives the wrong or faulty information about assets and liability. And they take the risk to earn profit before the contract between two parties is settle. This is occur any time when two parties mutually understand to come on an agreement . Moral hazard has the additional risks which negatively affect the other party. For example a seller not given proper information about their share and they earn on this shares before contract done.

- Adverse selection: The study which effect on relationship of borrower and lender. It refers to the fact when the in the markets there is two project both are equally expected value so the lender who is sell the choose safest and borrower have the riskiest projects while choosing risky activities in this hide the good projects . It refers the lender has the information related securities or shares and borrower have no information about that securities . Its tendency is who is in dangerous jobs they get the life insurance. This occurs when one party not to share the information to other or having all knowledge and the other have lacks of information.

b)Requirement to regulate financial market

Financial regulation is a form of regulation or supervision where it is required for financial institutions to cope up with certain requirements, restrictions and guidelines which helps in initiating and keeping integrity in the financial systems. There are various governmental and non-governmental organizations that are responsible for fulfil this aspect of financial institution. Since, financial market is a place where people trade in the form of financial currencies, commodities and other securities, it is important to regulate the market with the help of supply and demand prevailing in it. There are various factors that can affect financial market (Coffee Jr, Sale and Henderson, 2015). It can be in the form of unemployment, inflation, deflation, recession and other global regulatory factors. It becomes important for the authorities to ensure that develop a framework that can help in regulating the demand and supply aspect of the financial so that maximum number of people can gather the benefits out of it. Currency fluctuation in another aspect which requires regulation.

Implementation of sound regulatory framework can help n reducing the impact on economic financial system in such a manner that its magnitude of fluctuation can be controlled to the maximum. However, critically appraising the same, it is difficult to rely on only certain policies which must have been framed due to prevailing situations in the past. There can be requirement of formation of new policies that can help in better dealing with the situation in such a manner that financial market can appropriately be regulated (Awrey, 2012).

Financial inclusion is another right perspective that can be used to control the demand and supply aspect of financial market. It can help in initiating growth rate in such a manner that it can help in removing r reducing counter party risk involved in the decision being made regarding investment and withdrawal in the financial market. Critically appraising the same, there are other macro-economic consequences that can affect the market in a manner that it can also lead to crisis. In that scenario, applicability of should financial system in the economy can ensure that maximum amount of profit can be generated by the financial market even after having various macroeconomic constraints (Goodhart and et.al., 2013).

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

CONCLUSION

Based on the above report, it can be concluded that there are various levels of market efficiency that can help in analysing that in what situation the market is actually dwelling. It becomes important to analyse each and every aspect of financial market in such a manner that maximum profit can be generated out of it. Capital market and money market are the two different aspects of financial market and based upon the overall tenure of the investment and risk level, an investor can decide that whether he / she wants to invest in the same or not. Currency risk is the major risk that is involved in international trading aspect which can be covered by the investor with the help of hedging. There are various factors that can affect financial market. It can be in the form of unemployment, inflation, deflation, recession and other global regulatory factors.

You may also like to read: Financial Planning & Management | Tesco's Study

REFERENCES

- Afonso, A., Furceri, D. and Gomes, P., 2012. Sovereign credit ratings and financial markets linkages: application to European data.Journal of International Money and Finance.31(3). pp.606-638.

- Awrey, D., 2012. Complexity, innovation, and the regulation of modern financial markets.Harv. Bus. L. Rev..2. p.235.

- Bolton, P., Santos, T. and Scheinkman, J. A., 2016. Creamskimming in financial markets.The Journal of Finance.71(2). pp.709-736.

- Bond, P., Edmans, A. and Goldstein, I., 2012. The real effects of financial markets.Annu. Rev. Financ. Econ..4(1). pp.339-360.

- Challet, D., and et.al 2013. Minority games: interacting agents in financial markets.OUP Catalogue.

- Coffee Jr, J. C., Sale, H. and Henderson, M. T., 2015. Securities regulation: Cases and materials.

- Edmans, A., Goldstein, I. and Jiang, W., 2012. The real effects of financial markets: The impact of prices on takeovers.The Journal of Finance.67(3). pp.933-971.

- Goodhart, C. and et.al., 2013.Financial regulation: Why, how and where now?. Routledge.

- Junior, L. S. and Franca, I. D., 2012. Correlation of financial markets in times of crisis.Physica A: Statistical Mechanics and its Applications.391(1-2). pp.187-208.